Top Credit Insider Reveals RARE

"Credit Repair Loophole" That 738+ Normal People Have Used To FULLY Repair Their Damaged Credit Within 24 Hours...

WITHOUT paying ridiculous monthly fees or or wasting time trying to do it yourself getting little to no results in the same amount of time... see if you qualify below:

Continue Reading To See If You Qualify:

2020...

What's the first thing you think of when you hear that?

For many out there, it's synonymous with financial devastation ...

Many people and their families were hard-pressed into some tough times last year...

And when you combine difficult financial positions with an EXTREMELY rough job market...

You create a recipe for disaster when it comes to maintaining good credit.

Having to make the choice whether to keep up with car payments or pay the light bill...

You have the choose the security if you and your loved ones first every time.

But, unfortunately in the meantime, your credit suffers...

So, if you happen to be one of the MILLIONS that got their credit ruined in 2020...

I get it, it sucks...

When you lose your job or get laid-off due to things ENTIRELY out of your control... It's not fun.

And worst of all is the impact this past year is going to have on many Americans in the years to come...

The fact is, most people could NOT afford to keep up with all their bills and payments...

So, inevitably people have been watching their credit plummet to new lows...

Some even suffering below a 550 credit score...

The kind of score that doesn't even get you approved for a simple store card...

And probably gets you denied for ANY new or used car...

And a mortgage? Forget about it (unless you want to pay INSANE amounts in interest...)

To put things in perspective...

These are just a FEW of all the credit-based issues people are currently struggling with and aren't gonna go away any time soon...

Why am I so passionate about this? Because...

I Suffered Through Many Of The EXACT Same Credit-Based Issues That Many Of You Are Currently Facing, For Years...

I've experienced a lot of things you see I listed above...

I'll be the first one to tell you that NOT having good credit sucks.

And if you're anything like my old ignorant self...

Instead of being a part of the solution and trying to fix my credit...

I would chose to be ignorant.

I'd throw my credit issues under the rug and act like they didn't matter...

Out of sight. Out of mind.

And I'm. sure by now you could guess what I did...

I did what most teenagers do when they first get a credit card...

I used and ABUSED it.

The latest shoe drop... Credit.

Wanted a new TV for my room... Credit.

Gaming system became out of date? Just get the new one... Credit.

No money to go to College... Credit.

Couldn't pay for my first car in full... Credit.

The newest iPhone came out... Credit.

Pretty much any overpriced trend that so some reason I just "needed" to have...

You name it, I put it on credit.

And of course when I bought it, the last thing on my mind was having to pay for these things eventually...

Like most young and ignorant kids, I thought it was cool how I could buy something with NO cash.

To me, it was such a surreal thing...

I felt unstobbale.

UNTIL one day...

The bank statements started coming in...

And the interest started to pile up...

In fact, it got so bad at a point, I couldn't even afford the MINIMUM payment on my credit card...

My credit was crumbling and there was nothing I could do about it...

It seemed like every single time I checked FICO Score, the number was LOWER...

I kept falling further in "the red"...

602...

587...

551...

538...

513...

But there was a bigger issue at play here that was REALLY causing this...

It's something that if you DON'T fix now or in the near future, it's going to severely affect you and your family for the REST of your life...

When you don't look at credit the right way or use it the way wealthy people do...

You'll be stuck in the same old limiting beliefs that most people have about it...

They think that building wealth is about “saving money” or simply “spending less”...

But in reality, that's just NOT true, it never has been...

It has WAY more to do with building good credit and more importantly, leveraging it...

The hard truth here is, most American’s have NEVER had an opportunity to learn HOW to do any of these things:

- Fully pay off their debt

- Effectively save for retirement

- Buy their dream car or house

- Or simply build up some emergency funds and savings

Here's the scariest part about all this, listen to this:

According to FORTUNE Magazine nearlyTwo-Thirds of Americans can’t even pass a basic financial literacy test…

Many People Are Suffering From The"Credit Crash" Of 2020 Caused By Massive Job Diplacement & Not Having Basic Financial Literacy...

Here's the thing...

This isn't just a today issue...

This isn't just about not qualifying for the ideal house or nice car...

This is MUCH bigger than that...

Not only will this continue to KILL your Credit going forward...

But it's going to make it almost certain that you'll never be able to build true wealth for you and your family...

And after 2020, if you've been affected by the "Credit Crash" and are continuing to struggle with damaged credit...

I get it, it sucks...

There's nothing fun about not being able to get approved for any loan or even a low-limit credit card...

And maybe you even lost your job in the past year and that lack of income that has been the biggest factor in your credit dropping...

But there's something much, much worse long-term than some missed payments and lack of income...

It’s the one hidden thing no one ever realizes is flawed when it comes to their bad credit…

It’s their MINDSET.

When they think about their credit they’re stuck only focusing on managing debt and credit cards…

BUT we need to re-wire your brain to think this:

Credit is ACTUALLY about leveraging it to truly build wealth for not only yourself but future generations...

That way even your children's children will be set.

Trust me you don't want to miss this... (because I did and it hurt me for MANY years)

If you stay stuck in a limiting mindset about credit, the issues that are currently ruining your credit will NEVER go away…

It’s going to affect you and your family for the REST of your life…

In Fact, There Is Such A Thing As Using "Good Debt" To Build Wealth And Start Leveraging Credit…

Most people are completely unaware of the fact that there is such a thing as "Good Debt" and it can be used to start building wealth.

You'll be able to put yourself in great financial situations when you truly learn how to leverage good credit:

If you never address your credit, don’t think it’s important, and actually believe “cash alone” can get you out of any situation...

Poor Credit will haunt you...

You'll have a tough time getting the car of your dreams or even qualifying for a mortgage...

Our mission here at CM Financial Solutions is to make sure you and your family don’t have to face the EXACT same credit-based issues that many of my clients and I did…

We want to get you in the green!

When you take back control of your credit you can leverage it to get the things you’ve always wanted:

- Get a loan for that dream car you could never get…

- Approved for a mortgage to move into the best house on the block for you and your family

- Qualify for credit cards at SUPER low-interest rates

- Get lower car insurance payments

- And make pretty much ANY purchase that just wasn’t possible without good credit

We've helped 738+ People REMOVE negative items off their credit report and FIX their Poor Credit within as little as 24 Hours...

And I'm sure by now you're probably wondering...

Who am I and why should you even listen to me?

My Name Is Cristhofer Muñoz, And I Feel It's My DUTY To Give Back To People Struggling With Their Finances And Help Those Stuck Dealing With The Same Credit-Based Issues I Did For Years...

That's me staring off into the distance to see who was next to have me repair their damaged credit... (lol)

During my time as a Program Manager at Big-Tech Giant, Microsoft as a part of their Cybersecurity Engineering...

I was exposed to a lot of things that happened behind the scenes...

The types of things I knew were holding back everyday people like my friends and family that come from the Dominican Republic...

I was starting to realize how I could use my insider knowledge and skills to help people become more financially literate and build wealth for their families...

So I thought, "what better place to start than helping people FIX their poor credit?"

And I began on my journey to give back to the communities I grew up in and help those similar to my upbringing to get out of poverty for good.

Over the years I've now been able to not only fix people's credit but even help them learn how to invest their extra income, start saving for retirement, and build generational wealth.

In fact, I've been featured in several major publications for my work...

Here's one of my latest features in Yahoo! Finance:

And me getting interviewed on Fox News Now:

Or even the time a landed a placement in the ED Times:

But enough about me...

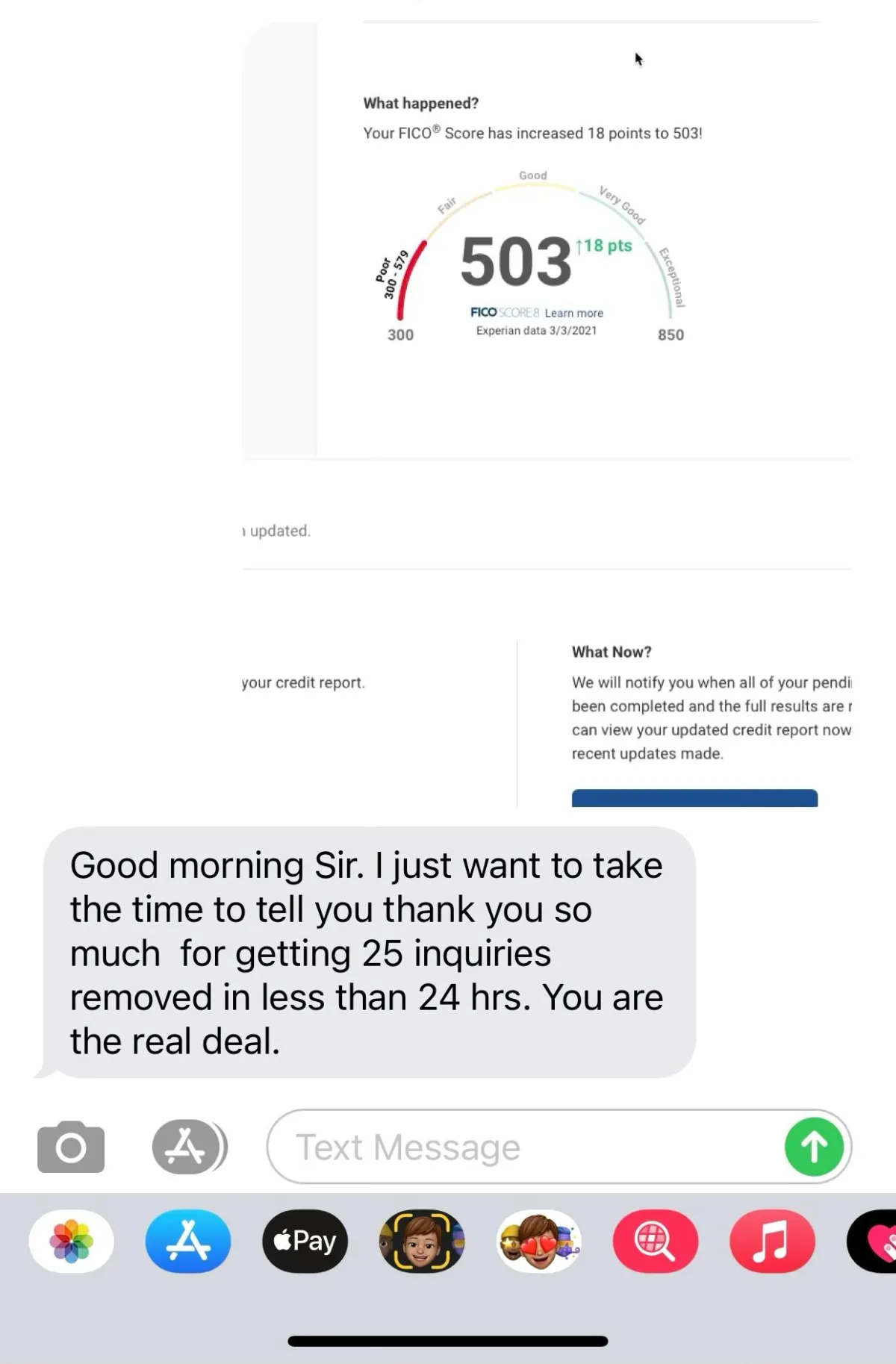

Remember when I told you I could FULLY repair your damaged credit score in as little as 24 hours?

It's true.

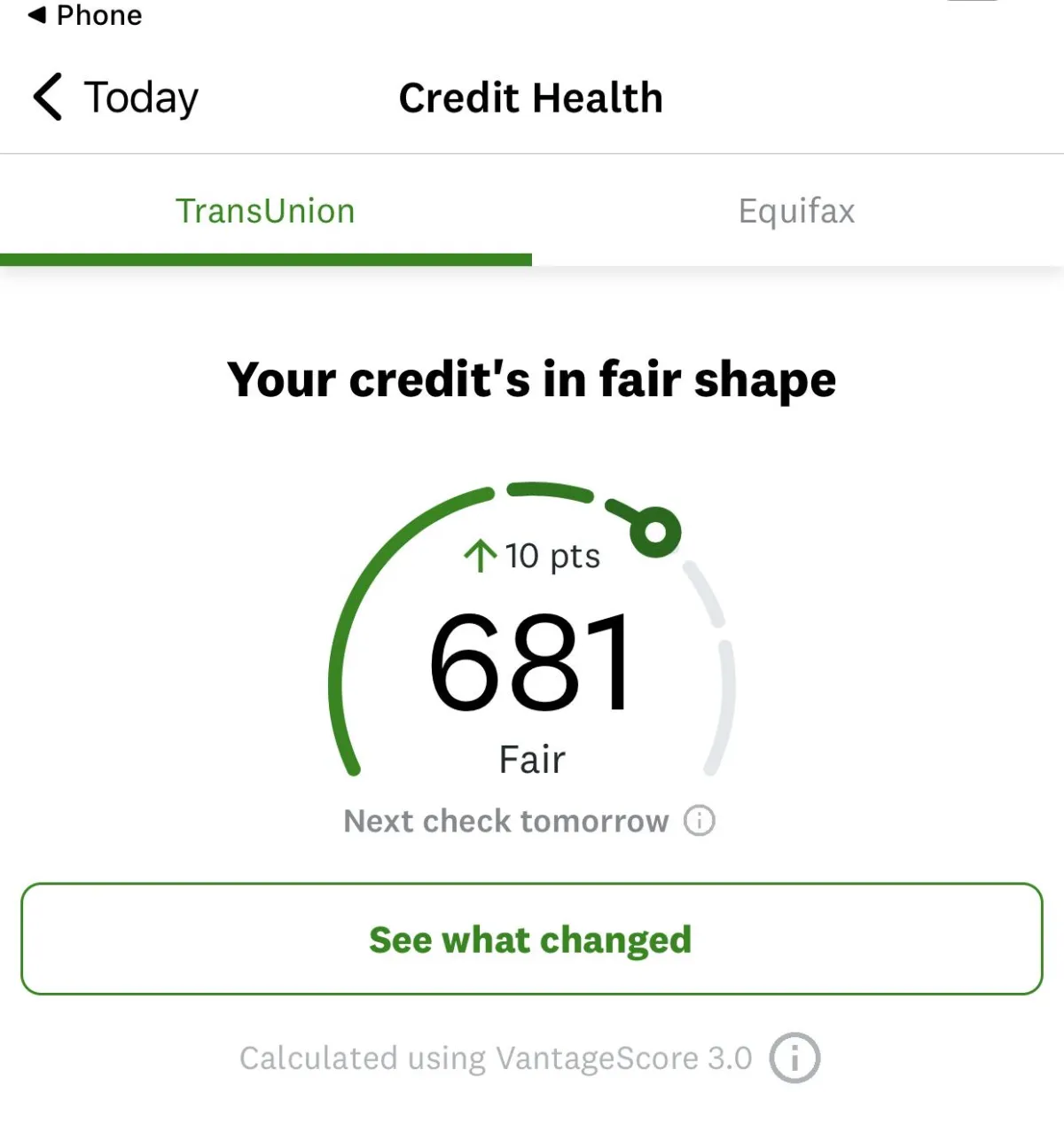

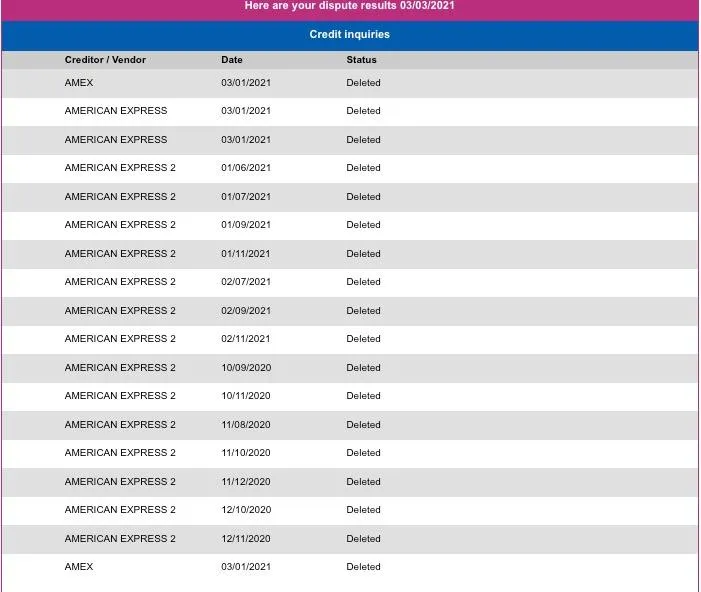

Here are just a few of the happy clients we've already helped Restore, Build, & Maintain a high credit score:

What’s Included When You Get Accepted For Credit Repair & Get Access To Our "Credit Repair Loophole"?

✅ Work 1-On-1 with a Certified Credit Specialist to repair your damaged credit

✅ Use our "Credit Loophole" (Suppression Method) to remove negative accounts on ALL 3 credit bureaus

✅ Dispute collection agency letters and get them off your back

✅ Inside access to new Tradelines that BOOST your Credit Score

✅ Even get access to over $10K in Primary Tradelines

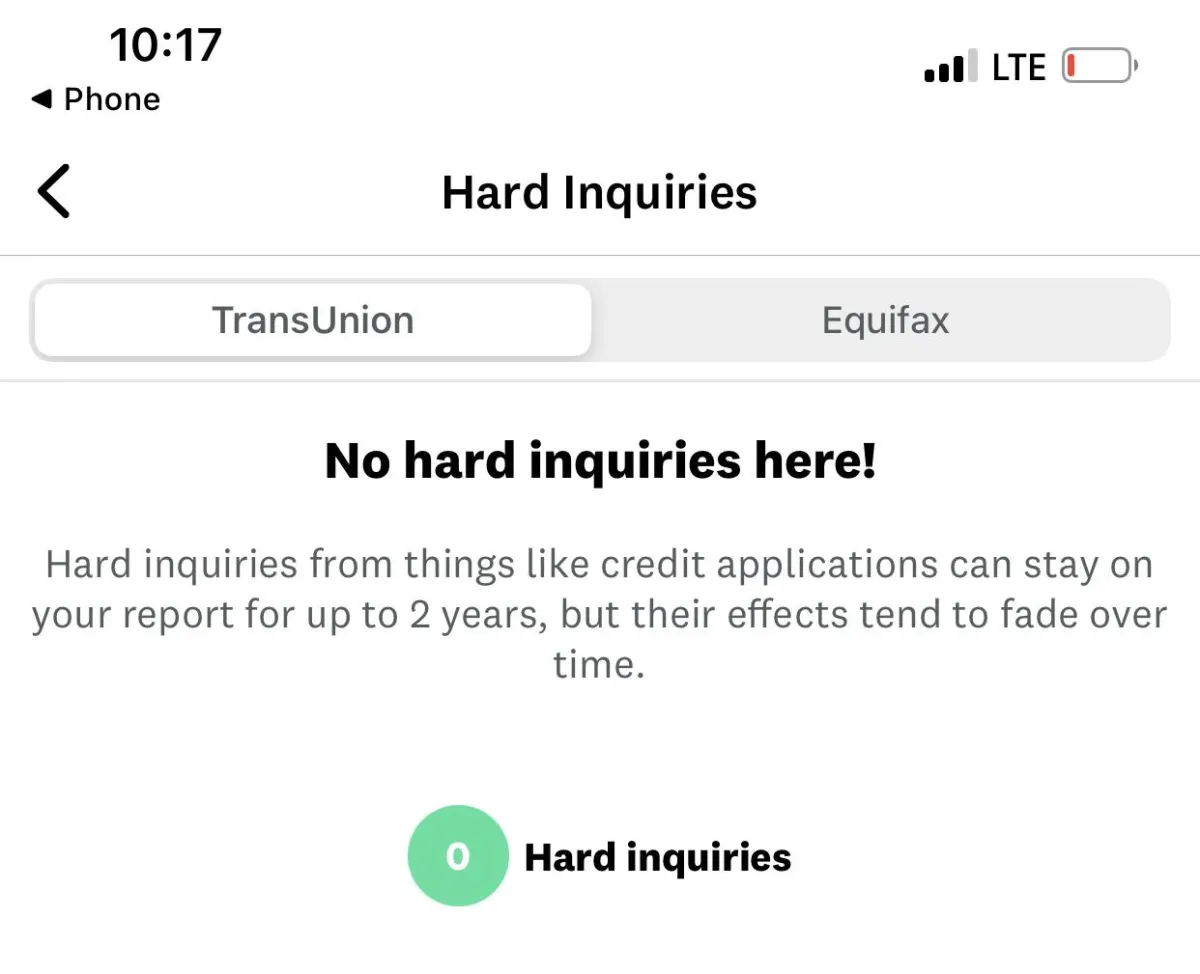

✅ 24-Hour Transunion Expedited Removal (w/ Inquiry Removal)

✅ Easy access to our team with Unlimited Customer Support

✅ Weekly accountability and Financial Literacy Credit Mentorship

✅ “Insider Credit Secrets” and Continuing Education to help you maintain good credit for the long-haul

✅ Get significant results in as little as 24-48 hours!

Our Simple 3-Step Process

1.) Receive Your FREE Credit Audit

FULL credit report Audit to help you find negative items that are inaccurate, unverifiable, or outdated. You will get a customized blueprint to improve your credit rapidly!

2.) Go Through Our

"Credit Repair Loophole”

To FULLY Repair Your Credit In 24 Hours!

We dispute incorrect and unverified information on your behalf so that you can achieve the accurate credit scores you deserve.

3.) Start Saving Money And Reap The Benefits Of Great Credit!

With a higher credit score you could lower your current interest rates, lower insurance premiums, and get better rates on new credit & loans. This has saved some of our clients thousands of dollars every year!

What Happens When You Have Poor Credit?

Without good credit, making big purchases can be extremely difficult and costly...

And at times can even cost you THOUSANDS in interest every single year.

Whether it’s a Mortgage on a house, an Auto Loan to buy your dream car, getting a quote on Insurance, or just a Credit Card to make everyday purchases…

Having poor credit can TRIPLE your interest rates and leave you in a very difficult financial situation…

Let’s take a look at the numbers from Credit.org:

Let Us Help You REPAIR Your Credit And Restore Your Financial FUTURE!

We've Been Successful In Removing:

✅ REPOSSESSIONS

✅ CHILD-SUPPORT

✅ SHORT SALES

✅ MEDICAL BILLS

✅ PUBLIC RECORDS

✅ HARD INQUIRIES

✅ FORECLOSURES

✅ STUDENT LOANS

✅ LATE PAYMENTS

✅ BANKRUPTCIES

✅COLLECTIONS

✅ JUDGMENTS

Our Exclusive “Credit Repair Loophole” Is The ONLY Fast Track To Get:

- “Insider Credit Secrets” to increase your credit score FASTER than you thought possible

- Access to these little-known credit hacks to get insane boosts in your credit score virtually overnight!

- Our step-by-step process on how you can qualify for HIGH LIMIT credit lines

- The EXACT blueprint our clients use to eliminate ALL the negative remarks quickly and legally!

So You Can...

🏠 Buy or Refinance Your Home

🚘 Purchase a New Vehicle

👩💼 Qualify for a Better Job

🏬 Move into a Better Apartment

👫 Reduce Stress in Your Relationship

💳 Get Approved for Credit Cards (At super low rates)

💵 Save Thousands of Dollars a Year

📉 Get Lower Insurance Payments

✅ The BEST Interest Rates

FAQs

Credit Restoration is legal and the law is on your side. Studies have shown that many Americans have errors on their credit reports and we're experts in getting them resolved.

1.) Is Credit Restoration legal?

Yes, it is legal and our services will help you to use the law in your favor. That law is called "The Fair Credit Reporting Act." The FCRA gives you the right to dispute any item on your credit report. If that item cannot be verified within a reasonable time (usually 30 days) it must be removed. Studies have shown that 79% of all credit reports contain errors. This is nearly 8 out of 10 reports. Therefore most credit reports improve immediately. For items that disputed that are not errors, a creditor or furnisher is often unable to find the records or signed documents within the allotted time and the item gets removed. Sometimes the furnisher will say it has been verified by not offer proof. It is our job to prepare documents that challenge this and we are very skilled at that.

2.) Is Credit Restoration worth my time and money?

Contrary to what credit bureaus want you to believe, credit restoration does work in most circumstances. But it only works if you are getting the best advice from an experienced professional. Anyone with a credit score below 720 can benefit long-term from the advice and information provided through credit education. However, there are limiting factors that will prevent us from helping you. Two main factors are: (1) your financial situation and/or (2) the time frame in which you need to reach your results. It is possible to remove anything from a credit report, even accurate items. For instance, if the creditor makes mistakes or does not adhere to the specific time frame, the negative item may be removed. Also, there are specific requirements the Credit Bureau, Collection agencies, and Creditor must adhere to, when placing items on consumer credit reports, if these requirements are not met, the negative items can be removed.

3.) What can I expect when I enroll in CM Financial Solutions?

We will guide you through the process from start to finish and prepare all your documents for you. We have a superb knowledge of credit scoring and experience working with creditors and credit bureaus. It may be difficult for an individual to communicate with creditors and bureaus without an adept understanding of their techniques and regulations in place for credit reporting. We have spent a great deal of time learning the laws that will help you to remove negative information on your report, which enables us to offer you a flawless, money back guarantee system.

(Clients should receive updated credit reports every 15-45 days. It is the client's responsibility to make us aware if updated reports have not been received).

4.) How long will it take to raise my score?

Initial results can come within 24-48 hours with some things being instantly removed off your credit report. We're quick and efficient and mail off dispute letters within the first week. Credit Bureaus have 30 days to respond to dispute letters, so you will see improvement within the first 45 - 60 days. NOTE: Each credit report is different, thus credit completion will vary based on your current credit standing and your credit goals. Many clients average 6-9 months in program.

5.) Why is the Credit Transformation Project different?

On average, we remove 90% of the negative items from a credit report. We're affordable, trustworthy and we GET RESULTS! No Hidden Fees.

6.) Will the removed items come back?

98% of items do not come back. By law, Collection agencies and credit bureaus must notify you before putting items on your report. Moreover, collection agencies can transfer debts, in which case, you have 30 days to respond to the debt. If an item does come back, we can target to delete.

7.) What items can you help me to remove and improve?

With our assistance, our clients have had great success with bankruptcies, collections, charge-offs, repossessions, medical bills, utilities, credit card debt, inquiries, old addresses, judgments, tax liens and student loans.

Click the button below to start your application process for our

“Credit Repair Loophole” today!